Personal Planning

Estate & Personal Planning in Kelowna

Preparing for your future security and that of your family is one of the most important legal tasks of many people’s lives. We offer professional estate planning and advance planning services to ensure your wishes are clear and that documents are in place for when they are needed.

Proper estate planning allows you to provide for and help your family cope when the time comes that you are no longer there.

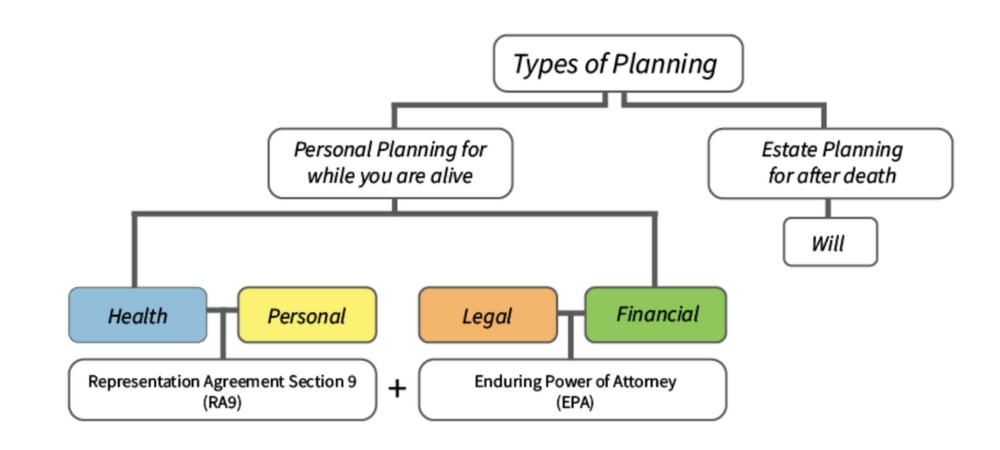

Personal planning covers important areas of your life you should consider while you are alive: health care, personal care, legal affairs and financial affairs.

Estate planning and personal planning are very important for everyone, no matter their age or health. However, people frequently leave this planning until it is too late for them to make their wishes known.

Advance Directive

An advance directive is written instructions about what health care you do or do not want in the future if you become incapable and a health care decision needs to be made. Unlike a representation agreement, an advance directive does not appoint a person to act on your behalf.

If you have both a representation agreement and an advance directive, the representation agreement takes priority. However, your representative must follow any instructions or wishes, including those set out in an advance directive.

Power of Attorney

A power of attorney allows a capable adult to appoint someone to act for them relating to their financial and legal matters in the event they are unable to do so themselves or need assistance due to illness, injury or disability. This may include, buying and selling real property and taking care of the adult’s banking accounts and investments. Powers of Attorney come in many forms. They can be either specific or general. As the name implies, a specific Power of Attorney is given to achieve a specific goal, like selling a real property. Once that goal has been achieved, the specific Power of Attorney is no longer valid. A general Power of Attorney can be used for any financial purpose.

There are enduring and non-enduring Powers of Attorney. An enduring Power of Attorney can be used by the Attorney while the adult is still capable of managing his/her own financial affairs, and it continues to be valid even if the adult loses his/her mental capacity. An enduring Power of Attorney does not expire; if the capacity is lost by the adult, the Attorney may keep using the enduring Power of Attorney for as long as both the adult and the Attorney are alive.

A Non-enduring Power of Attorney automatically expires when loses the mental capacity.

Representation Agreement

A representation agreement appoints a representative, or multiple representatives, to make decisions regarding an individual’s health and personal care in the event they are unable to communicate their own wishes.

The purpose of a representation agreement is to allow an adult to arrange in advance how and by whom the decisions about their health care or personal care will be made if they become incapable of making decisions independently.

There are two types of Representation Agreements: Section 7 (Standard) Representation Agreement and Section 9 (Enhanced) Representation Agreement. Section 7 Representation Agreement covers minor health care and routine financial decisions.

Section 9 Representation Agreement gives greater authority to the Representative, including the authority to make critical decisions regarding the adult’s medical treatment. One of the most important things to remember is that a Representation Agreement gives the representative legal guardianship rights over the adult who appointed him/her. Representation Agreements do not expire.

Last Will and Testament

What is a will? A will is a legal document that leaves instructions for the distribution of assets, guardianship of minor children, and the designation of an executor who takes care of administering the estate. Who needs a Will? The answer is simple: everyone. Surprisingly, almost half of all adult British Columbians today do not have a current Will. What are the consequences of not having a properly executed Will? In purely monetary terms it means that in case of unexpected demise of a loved one, the family would have to pay way more to settle the estate in court as compared to the cost of dividing the assets through a Will. If there are minor children, things would get even more complicated. Without a Will and with no surviving parents, the right to care for underage children might be bitterly fought over in court by various relatives, close and distant. And if no relative steps forward as a suitable guardian then the children’s care becomes the government’s job. It is not unlikely that the children may find themselves in a foster family. A simple way to prevent this scenario is to appoint a guardian in your Will.